how to close gst account malaysia

Seal the validated original refund form in an envelope given to the tourist at the Approved Outlet and post it to the Approved Refund Agent to process the GST refund within 2 months of. Any refund of tax may be offset against other unpaid GST customs and excise duties.

Eon Member Privilege Day In Malaysia Privilege Members Event Exhibition

The Royal Malaysian Customs Department RMCD has already commenced GST closure audits even arranging for tax professionals to conduct some audits for and on their behalf.

. Vote for GST Portal performances and view the poll result here. All supplies of goods and services which are now subject. Account for GST on taxable supplies made and received ie.

Close Information you need to close deregister your GSTHST account When you are ready to close deregister your GSTHST account you will need all the. Filing GST Returns GST returns must be submitted. Taxpayer Access Point TAP You have been successfully logged out.

Complete your transaction and. What does the MOF statement dated 16 May 2018 relate to the imposition of GST at 0 and its impact on GST. Total annual expenses RM3120 Failing to submit Annual Return and Audited Accounts to SSM will result in fine and penalty charged to the Company and to directors personally.

Firstly it is the complexity of accounting treatments of transactions. A registered person must comply with the requirements under GST legislation as follows. GST is a tax charged on the supply including sales of goods and services made in Malaysia and on the importation of goods and services into Malaysia.

Output tax and input tax. The new SST in Malaysia is a. Steps To Cancel GST Online Registration On The GST Portal.

John subtracts his GST credit from the purchase price 1100 - 100 GST 1000 and uses 1000 to calculate the deduction he is entitled to in his tax return. Commits an offence and shall on conviction be liable to imprisonment for a term not exceeding seven years or to a fine not. Choose the amount of GST-SOL youd like to convert or sell.

Refund will be made to. In the case of retailers they. Penalty for obstructing etc officer of goods and services tax.

Find out the right legislation. The Goods and Services Tax better known as the GST is a generalised and all-encompassing taxation applied to any goods and services. After spending a number of years studying Goods and Services Tax GST Malaysia was the last country in the Association of Southeast Asian Nations ASEAN excluding Brunei.

MALAYSIA GOODS SERVICES TAX GST Royal Malaysian Customs Department You have submitted your request successfully. Collect and complete an original refund form which you must get from the sales assistantcashier at the store and ensure that the refund form is completed correctly. In Malaysia a person who is registered under the Goods and Services Tax Act 201X is known as a registered person.

Even though GST is charged on the. 1 Getting Ready for GST - Registering for GST 2 Registration revised as at 23 April 2014 3 GST Electronic Services Taxpayer Access Point TAP Handbook 4 Click Multimedia. All business and accounting records relating to GST transactions are to be kept in Bahasa Melayu or English for a period of seven 7 years.

Confirm the sell price and fees and close your sale of STEPN Green Satoshi Token on Solana. We offer you a range of convenient payment options. You may now close this window.

Click Here to Start Over. TAP TAXPAYER ACCESS POINT A BETTER TAX SYSTEM. GST Accounting Services in Kuala Lumpur Penang.

And secondly the hefty penalties imposed by the Act. Goods and Services Tax Act takes effect from 1 April. Make a payment.

Download form and document related to RMCD. Beginning 1st October 2015 the registered person excluding retailers must use a computer generated invoice or pre-printed invoice which is GST compliant. The SST is a replacement of the previous Goods and Services Tax GST in Malaysia which prior to this imposed a 6 tax rate on all taxable goods and services.

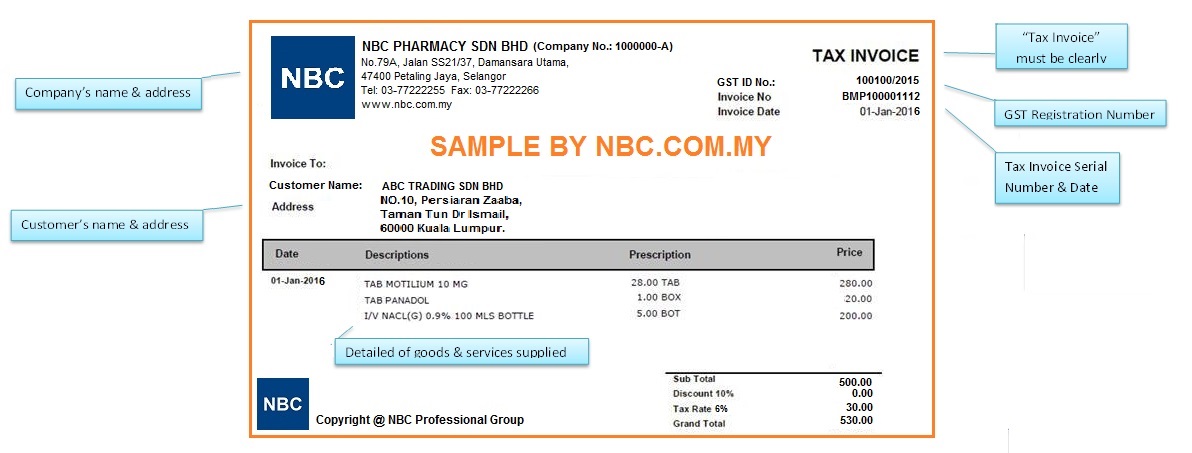

What Is Tax Invoice How To Issue Tax Invoice Goods Services Tax Gst Malaysia Nbc Group

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Gst In Malaysia Will It Return After Being Abolished In 2018

How To Start Gst Get Your Company Ready With Gst

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Flipkart Seller Hub Integration With Gst Accounting Software Eztax Accounting Software Accounting Create Invoice

Malaysia Sst Sales And Service Tax A Complete Guide

Cipla Q4 Mahindra Palmoil Crudeoil Gst Taxation Services Audit And Assurance It Consultin Accounting Services Secretarial Services Consulting Business

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Malaysia Malaysian Tax Enforcement In 2020 Updates Bdo

Malaysia Sst Sales And Service Tax A Complete Guide

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Malaysia Goods And Services Tax Gst Penalties Goods Services Tax Gst Malaysia Nbc Group

0 Response to "how to close gst account malaysia"

Post a Comment